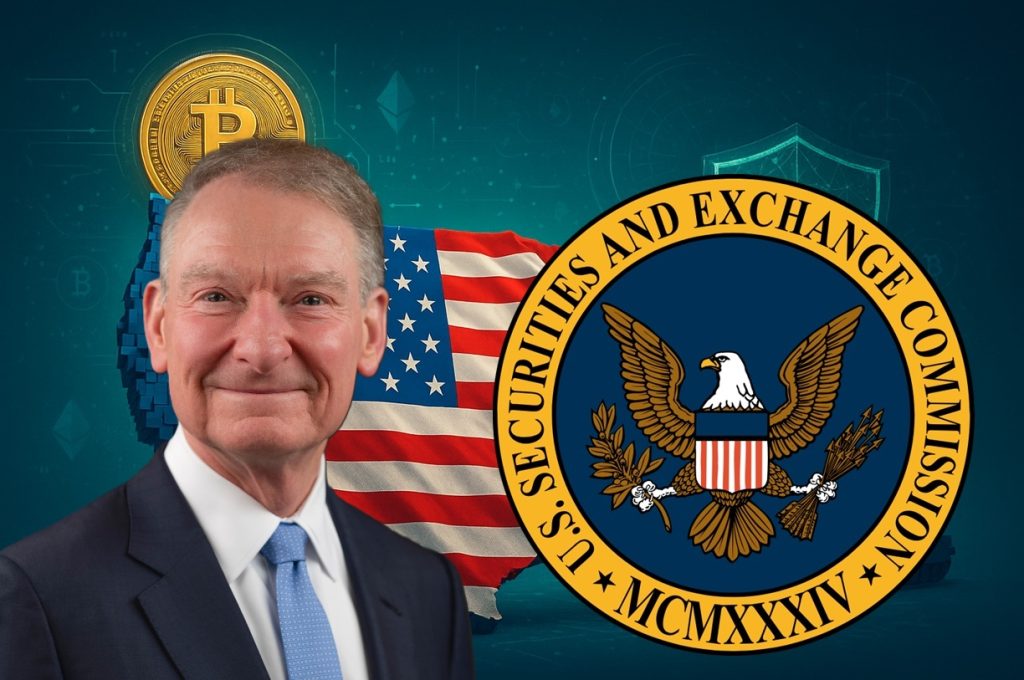

- SEC Chair Paul Atkins declared that entrepreneurs should be able to raise capital on-chain without worrying about legal uncertainties.

Paul Atkins, chair of the US Securities and Exchange Commission (SEC), dropped another bomb that shook the foundations of the decentralized finance (DeFi) landscape. During a keynote address at the inaugural Organisation for Economic Co-operation and Development (OECD) roundtable on Global Financial Markets, the official expressed his support for enterprising individuals and companies raising capital on-chain.

On-Chain Capital Raise Without Worries

The official stated that the SEC must ensure that entrepreneurs can raise capital on-chain without having to hurdle with legal uncertainty. With that, he pointed out that it should be the government’s responsibility to establish commonsense guardrails that do not introduce unnecessary regulatory obstructions stifling innovations. Together with crypto, he believes artificial intelligence (AI) is also shaping the new era of finance.

Atkin’s speech mirrored his statements during the SEC’s Project Crypto initiative unveiling. The agency created the program through the guidance of its Crypto Task Force. Its goal aligns with the findings of the White House’s Crypto Policy Report in July and President Donald Trump’s campaign promise of making America the “crypto capital of the world.”

Additionally, the crypto-friendly SEC chair revealed that the Congressional Working Group has directed them and other US regulators to modernize their “outdated rulebooks.” Hence, he believes the launch of their agency’s Project Crypto comes at an opportune time.

“President Trump calls America a ‘nation of builders,’” said Atkins. “Under my chairmanship, the SEC will encourage those builders, not suffocate them under red tape.”

“Our goal is simple: to spark a golden age of financial innovation on US soil,” he added. “Whether through tokenized stock ledgers or entirely new asset classes, we want breakthroughs to be made in America’s markets, under American oversight, for the benefit of American investors.”

In his closing remarks, Atkins urged the OECD and other partner organizations to work together to advance regulations to better cater to the rapid changes in the financial markets. Moreover, he emphasized the SEC’s commitment to protecting investors while offering plenty of room for innovators and entrepreneurs to thrive.

Why This Matters?

Atkins’ latest move underscores the current SEC regime’s pro-crypto stance. This is a significant departure from the previous administration under former SEC Chair Gary Gensler, which revolved around a “regulation by enforcement” approach that led to several lawsuits against crypto companies and the exodus of other businesses related to the digital asset industry from the US.

What’s your Reaction?

+1

0

+1

0

+1

0

+1

0

+1

0

+1

0

+1

0