Central banks take the spotlight this week as monetary policymakers from Washington to Tokyo cut to the chase on the balance of economic risks. Though the two-day meeting (Tue-Wed) is the main event, rate decisions by the Bank of Canada (Wed), the Bank of England (Thu), and the Bank of Japan (Fri) may reveal much about the degree to which US tariffs are disrupting economies around the world. The same goes for rate calls in Brazil, Indonesia, Norway, and Taiwan.

There’s little doubt in financial markets that the Federal Open Market Committee (FOMC) will cut the federal funds rate by 25 basis points on September 17. And odds are there will be no dissenting votes this time, as weaker employment data give Fed Chairman Jerome Powell economic cover to make President Donald Trump’s day. Though Trump wants a bigger move, we remain convinced that a 50-basis-point cut is unlikely at this time.

Yet all in all, this will be a unique FOMC meeting. For one thing, Senate Republicans are racing White House economic adviser Stephen Miran onto the Fed Board in time to argue in favor of Trump’s desire for sharply lower rates. Might Miran dissent in favor of a 50-basis-point easing? Also, the courts are fast-tracking a decision on whether Trump can fire Governor Lisa Cook for alleged mortgage fraud.

Over in Tokyo, the BOJ is also navigating uncharted territory. A couple of months ago, most economists figured Governor Kazuo Ueda would hike rates by 25 basis points to 0.75% on September 19. Now, almost none do amid tepid economic growth and uncertainty over China’s growth trajectory and Trump’s trade war plans.

Here’s a look at this week’s economic reports that are most likely to impact the Fed’s thinking about the economy:

1. Retail sales

August data on (Tue) could match July’s 0.5% m/m increase. Reasons to expect the rise include a 6.6% y/y increase in the Redbook retail sales index through the week of September 5, private wages and salaries in personal income rising 0.3% m/m to a new record high during August, and the strength of the forward revenues of the Retail Composite (chart).

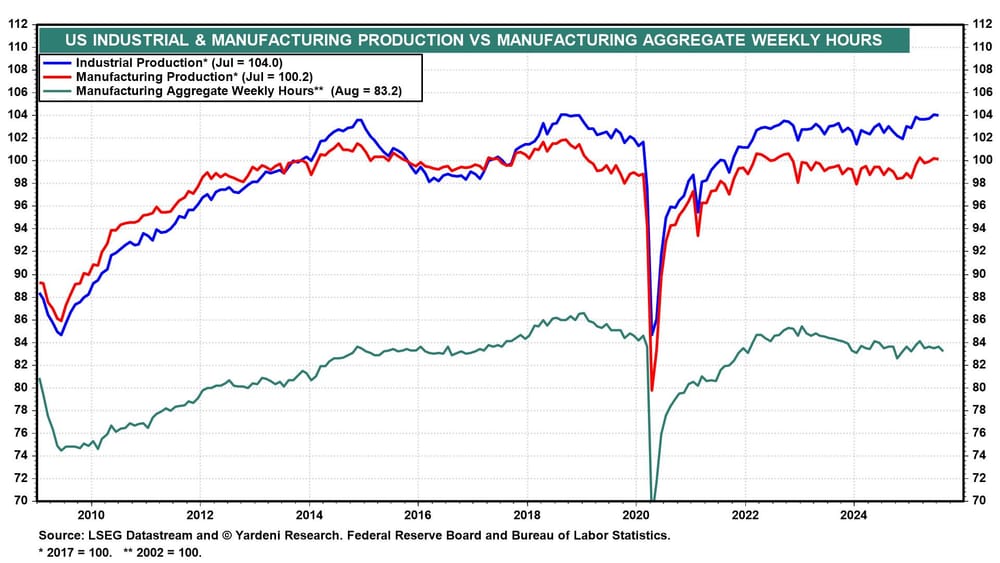

2. Industrial production

August (Tue) likely remained lackluster given weaker manufacturing hours worked and the 48.7 reading of the ISM manufacturing index last month (chart).

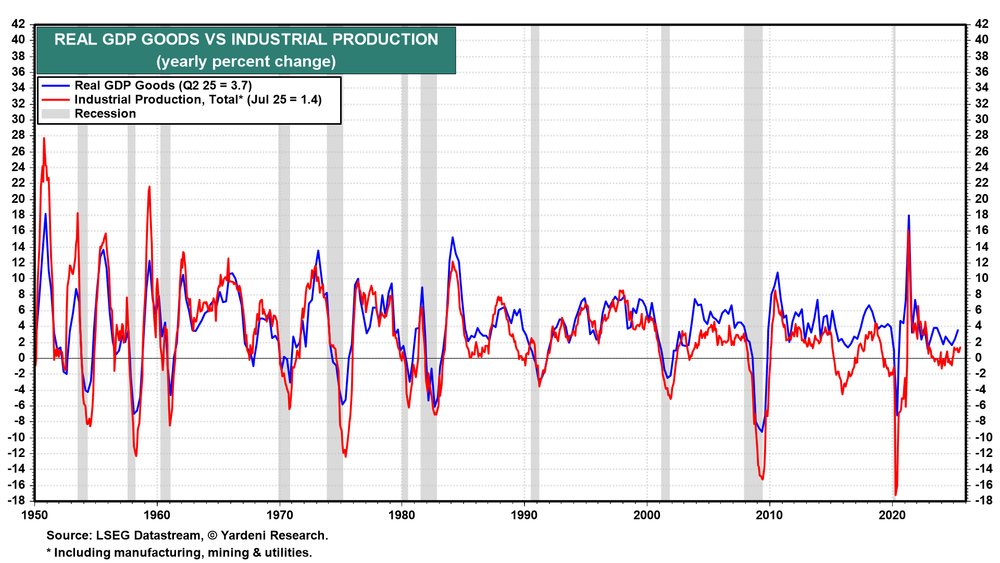

However, since 2001, the y/y growth rate in has been consistently weaker than the growth rate of real goods (chart).

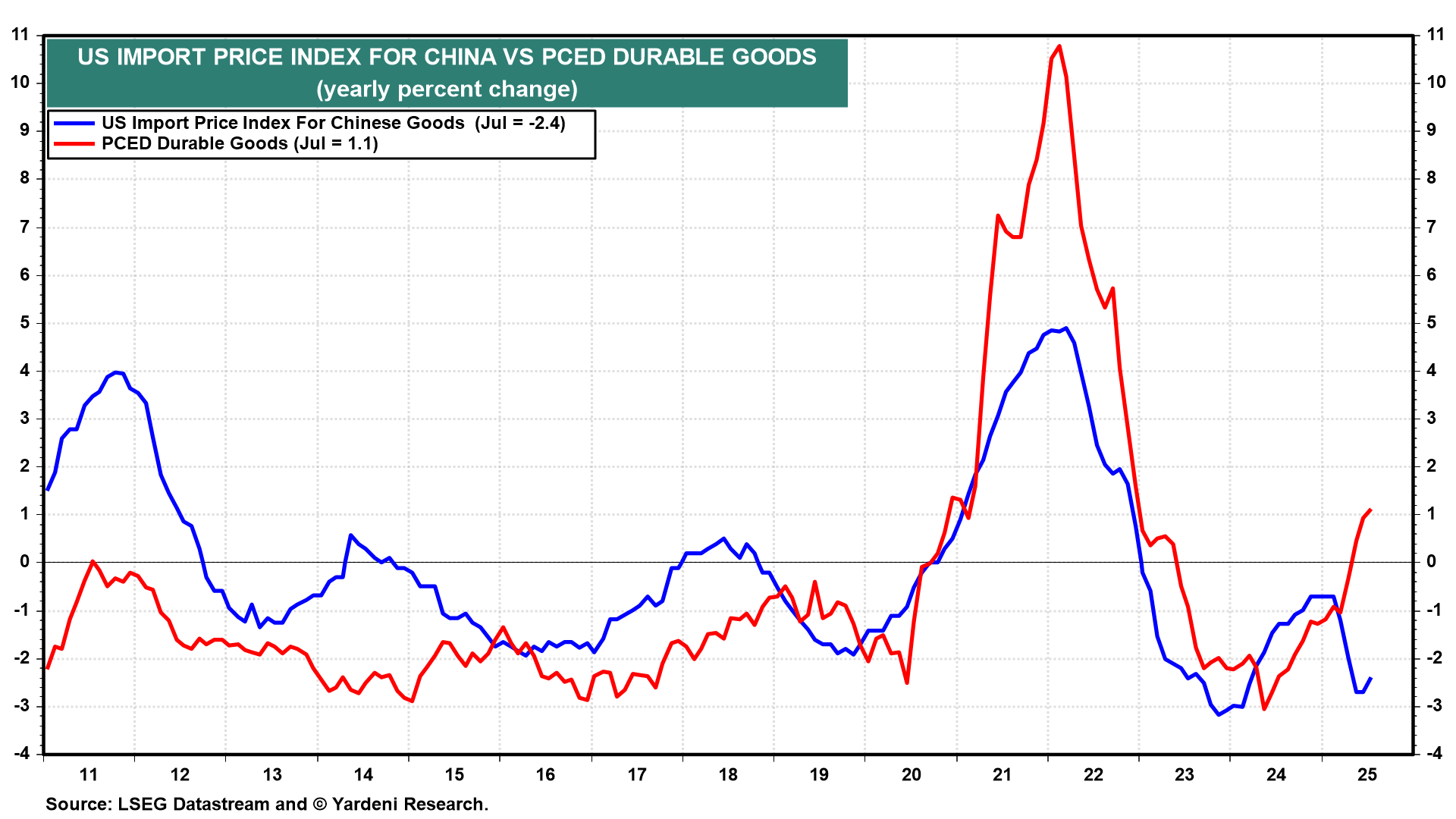

3. Import prices

Import prices (Tue), especially those from China, have had a deflationary impact on consumer durable goods prices in recent years, until both rose sharply during the 2022-23 inflation spike (chart). Now, Chinese exporters to the US are cutting their prices in an effort to offset tariff-fueled price increases in US consumer durable goods.

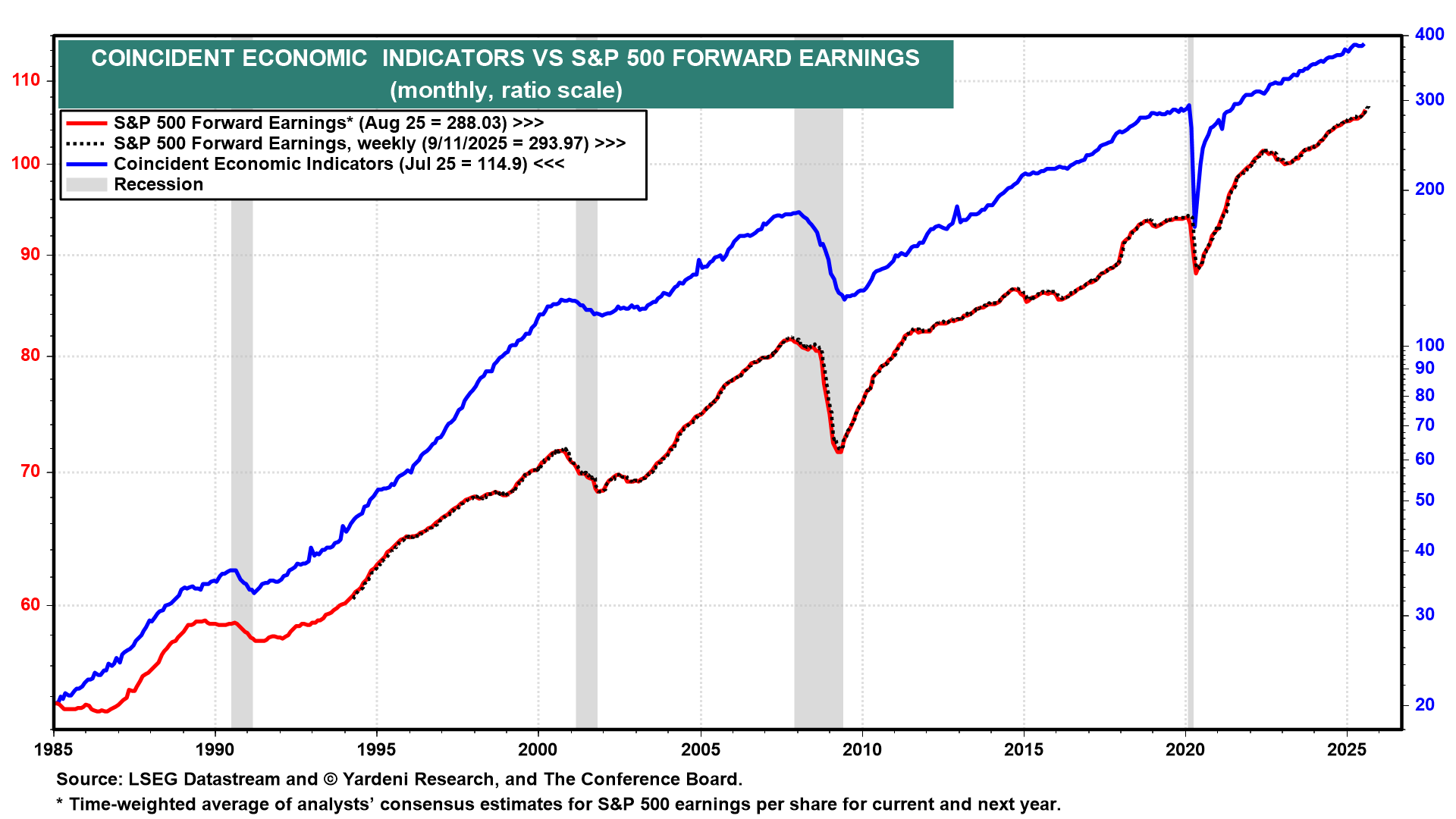

4. Composite cyclical indicators

A soft August reading is likely from the Conference Board’s Index of Coincident Economic Indicators (Thu). That’s because employment and industrial production were weak in the previous month. On the other hand, our favorite weekly coincident index of the economy is the S&P 500’s forward earnings, which has recently been rising at a faster clip, reaching record highs (chart).