Before I begin talking about today’s , a quick word about the 24th anniversary of the terrorist attacks of 9/11, as someone who worked 1 block from the Towers, I can tell you it’s a day I will never forget, and it’s filled with images I can never erase. But I also remember that in the weeks that followed, the country was unified in a way I’d never seen.

Rudy Giuliani was “America’s Mayor” for his courage and steady hand during the disaster and in the period that followed. When I traveled to the Midwest, menus were filled with ‘Freedom Fries’ and strangers asked with concern about my family and friends when they heard I was from New York. It seems crazy to me that only 24 years removed from that, the country is divided in a way I’ve never seen. Everyone said, “We will never forget.” And then they forgot.

But I do not forget. I give prayers and thanks for the brave first responders I saw that day and for the families of those who didn’t return. And you should too.

All of which makes the monthly CPI report seem very small. In truth, it is small all of a sudden. From being one of the most important releases for a couple of years because of the Fed’s assumed reaction function, it has been abruptly pushed to the back. This is partly because of the weak Employment data and the massive downward revisions to the prior data.

Still, that point is reinforced by the Fed’s recent adjustment to the inflation targeting framework, in which they removed any imperative to make up for periods of high inflation by engineering lower inflation so that the reaction function is basically one-way. See my write-up on this here. I guess there’s an ironic parallelism here. After the inflationary 1970s and the pain of bringing inflation back down, the Fed said, “We will never forget.” And then they forgot.

But I do not forget. And neither should you. An investor’s nominal returns are irrelevant (except to the IRS). What matters is real returns, and a period of higher and less stable inflation has historically resulted in lower asset prices since the most important indicator of future returns over normal investing horizons is the starting price. If markets need to adjust to higher inflation to give higher nominal returns, the easiest way to do that is to lower the starting price. So whether the Fed cares, we should.

And with that, we came into today with real yields having fallen some 20bps this month, but with inflation expectations having not declined much at all. Obviously, that’s the market’s reaction to the presumed tilt of the .

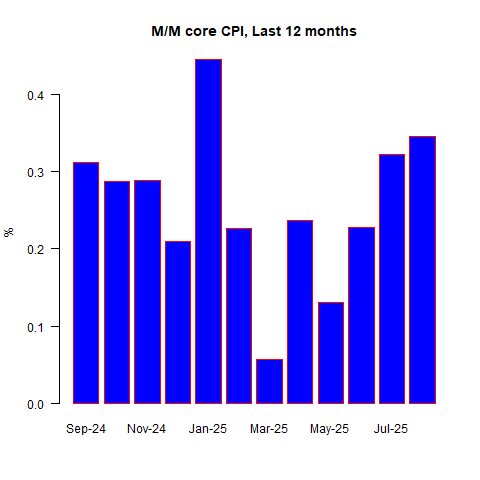

The CPI report was slightly above expectations, which were already somewhat higher than in prior months. So when people tell you this was a ‘small miss higher,’ that’s mainly because economists adjusted their expectations, not because the number was similar to prior months. (seasonally adjusted) was +0.382% (expectations were +0.33%), with at +0.346% (expectations were +0.31%). Markets have not reacted poorly to this figure, but I wonder if core had been slightly higher and rounded to +0.4% if we’d have seen more introspection.

But as I said, this is a ‘small miss’, but that does not mean it was a small number. Indeed, with the exception of the jump in January associated with tariff noise, this is the highest core figure in 17 months.

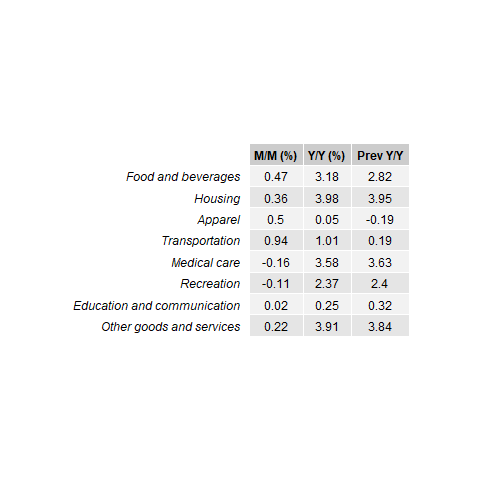

There were several upside categories, but one of them was not Medical Care. Some people had been looking for a move higher here, and Doctor’s Services rose a bit, but Medicinal Drugs fell -0.372% m/m and is now down year/year. That surprises me, but there are a lot of pressures on the drug industry right now, and it is going to take a while to see how it shakes out.

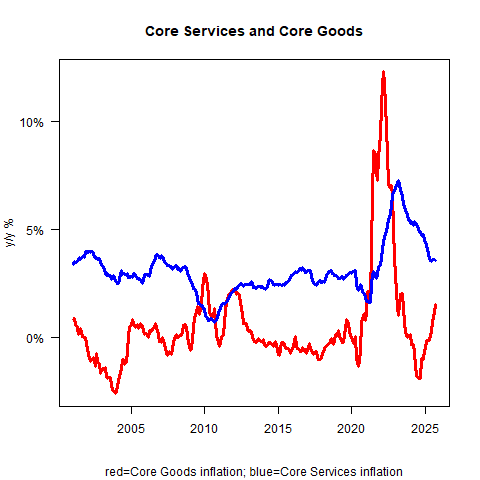

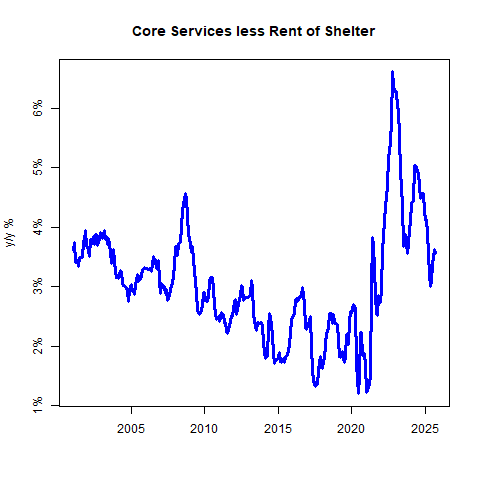

Core goods prices continued to accelerate. On a y/y basis, core goods are +1.54%. Except for the COVID spike, this is the highest level of core goods inflation since 2012. Some of that is definitely due to tariffs, and that will trickle in for a while. However, the long-term concern is that the deglobalization/re-onshoring of production will make it very difficult to return core goods inflation to the persistent mild deflation we have enjoyed for a long time. And without that, it is tough to get core inflation to 2%, especially if core services (+3.59% y/y) stop improving as the chart sort of hints it might.

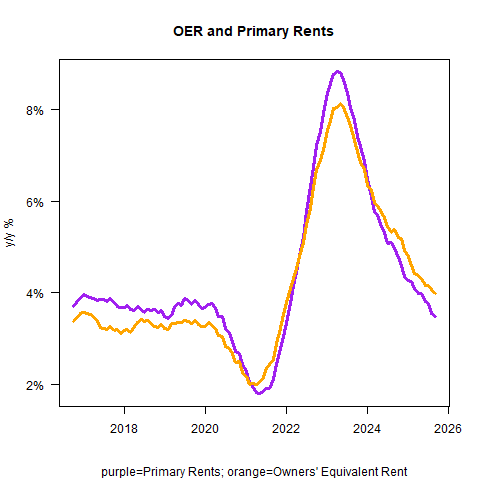

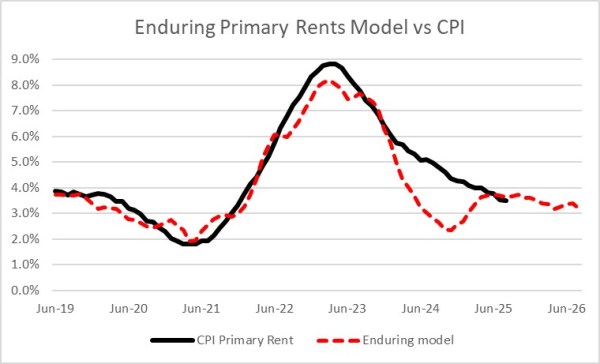

One surprise you will hear a lot about is Owners Equivalent Rent, which was +0.38% m/m. Primary Rents were +0.30% m/m. Both of those are higher than the recent figures, but this looks like some residual seasonal-adjustment issues to me. The y/y for both continues to decline, albeit at a slowing rate, which means that the number we dropped off from last year was higher than the upside surprise of today.

Rents are on schedule.

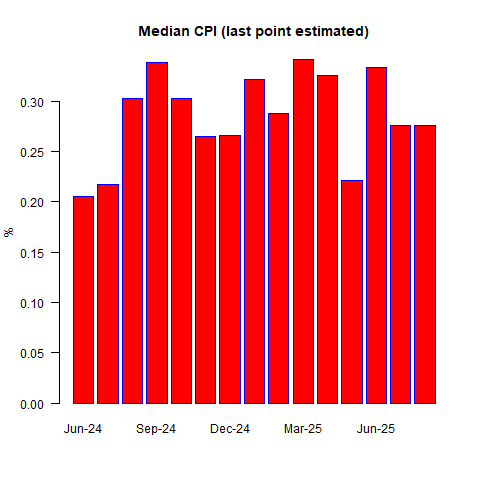

We also saw another jump from airfares, +5.87% m/m, and Lodging Away from Home (+2.92% m/m) finally rebounded after months of weakness. Used cars were +1.04% m/m, and new cars +0.28%. When you look at all of the pieces, it adds up to Median CPI being almost the same as last month: my early guess is +0.276% m/m.

Turn that picture any way you want to. I don’t see a downtrend.

When we break down inflation into the four main pieces, none of them is in deflation, and none seems to be an overt drag or pulling everything else up. Food and Energy is +2.16% y/y. Core goods are +1.54% y/y. Core services less rents (aka Supercore, chart below) are +3.56% y/y. And the Rent of Shelter is +3.61%. How do you want to get inflation to 2% from those pieces?

Long-time readers will know this does not surprise me. Median CPI will be around 3.6% y/y again. That’s where we are. We overshot my ‘high 3s, low 4s’ target to the downside a bit, but we’re back up in the mid-to-high 3s. I’ll take that as a win.

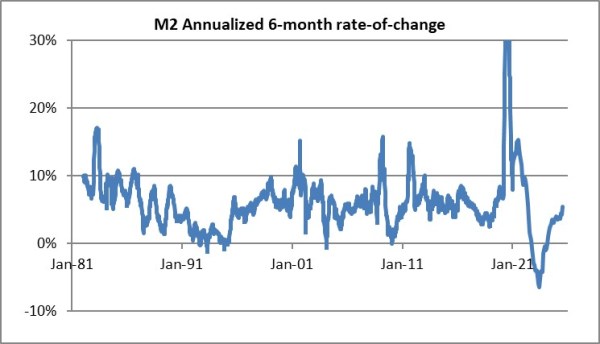

I want to share the money supply chart. On an annualized basis, we’re near 6% y/y over the last six months. That is back to pre-COVID levels, and is too fast in this environment. You can’t get 2% inflation with deglobalization and sour demographics if you’re running the monetary playbook from when you had globalization and positive or neutral demographics.

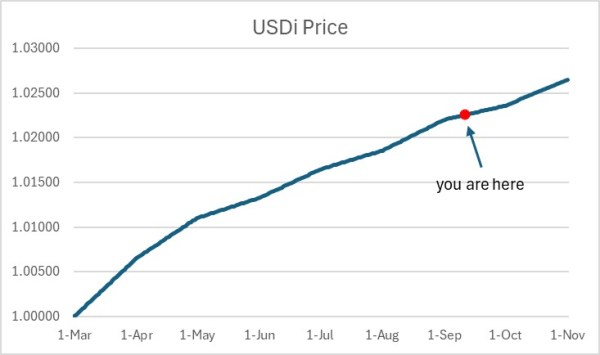

And finally, we now know USDi’s price through the end of October.

So what does all of this mean for policy? Well, see what I said above about inflation targeting and the change of the Fed’s operating framework. The most important things to the FOMC right now are, in order:

- Employment

- Politics, and jockeying for position to be named next Fed Chair

- Internal modeling about tariffs, inflation expectations, rents, etc.

- Actual inflation numbers, like CPI

35th or so in importance is “the quantity of money,” if it’s on the list at all. You can probably glean from my list that I think the Fed is likely to ease. Let me make clear that I do not think that a wise Fed chair would even consider easing with median inflation steadying around 3.6%, and a 50bps cut would be laughable. However, this is not a wise Fed chairman, and this one is going to ease. In my gut, I think the Fed will cut by 25 basis points, but with several dissents for a 50-basis-point cut. I would not be shocked with a 50bps ease, even though it is entirely boneheaded to do it with inflation still running hot with no clear path for it to decline to what used to be the target.

But that’s the point, I suppose. Is there even a target if the Fed doesn’t mind missing it?