- Dollar and US equities rally; crypto market is indecisive

- Volatility remains elevated despite improved risk sentiment

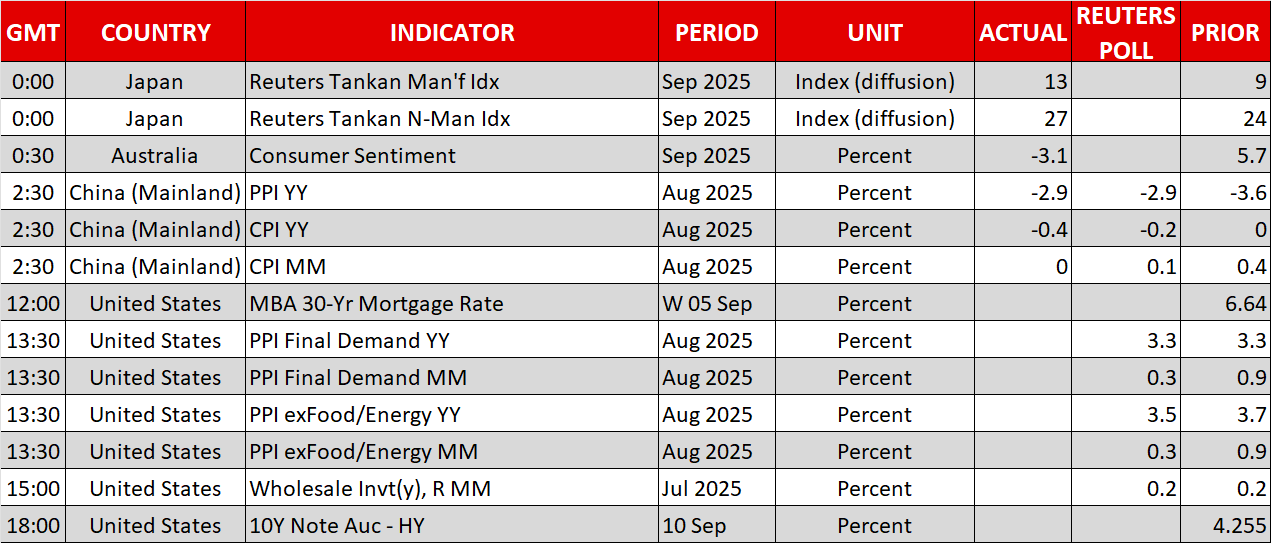

- US PPI data could show tariff impact ahead of CPI report

- Gold and oil are supported by broader geopolitical tensions

Improved Risk Appetite

Risk appetite is on the mend this week, with US equity indices erasing last Friday’s correction after the soft US . The index posted a new all-time high yesterday, even though Apple (NASDAQ:) lost some ground after the introduction of its iPhone 17, while both the and indices tested their respective highs.

In contrast, the cryptocurrency market is still searching for direction. has once again climbed above the $111k level, with remaining under the weather. Interestingly, the first ETF is set to start trading on Thursday, with & ETFs in the pipeline.

Despite the improved risk profile, and the absence of Fedspeak allowing investors to focus on Thursday’s report and next week’s Fed meeting, volatility remains heightened across markets. Specifically, both the Dow Jones and indices are experiencing near-monthly high volatility, with gold following a similar trend after rising above $3,650.

Gold and Oil Are Supported, as Israel Ups its Game with Qatar Strike

Commodities remain in the spotlight, greatly affected by geopolitics. The Ukraine-Russia conflict is continuing at full force, with Poland forced to respond to an airspace violation by Russian drones. But the key event of the day took place in the Middle East. Israel targeted Hamas leadership residing in Qatar, a precious US ally, showcasing its ability to strike everywhere in the region, even at the expense of US interests.

Notably, appears to have woken up. It is recording its third consecutive positive session after trading at a three-month low of $61.89 last week, despite the OPEC+ alliance deciding on another production increase in October. Saudi Arabia is spearheading this effort, aiming to recapture valuable market share.

Focus Is Gradually Shifting to US Data

Following yesterday’s record-breaking 911k preliminary downward revision in employment, which completes the weaker labour market picture, the focus in now turning to incoming inflation data. The (PPI) report is due today, with investors extremely interested in identifying the potential impact of tariffs on producer prices, particularly as China’s rate dipped to negative territory again in August.

Today’s schedule is just the appetizer for tomorrow’s report, which could prove critical for next week’s Fed meeting. A combination of softer producer and consumer price pressures could support the doves’ argument for a 50bps rate cut, signaling the Fed’s determination to get the US economy back on track. That was the motivation for the September 2024 50bps move, but now there is the ‘Trump’ element to be considered. The has to prove that any decision taken on September 17 will not be a product of political pressure, which is tougher to achieve than it sounds.

Meanwhile, Fed Board member Lisa Cook will participate in next week’s meeting, as a federal judge blocked Trump’s decision to remove her from the Fed while legal proceedings are ongoing. The legal battle has just commenced, with most commentators expecting this case to reach the Supreme Court.

Tariffs Ban Reaches the Supreme Court

Cook’s removal will probably be the second Trump-related case to be decided by the Supreme Court, as it has been announced that the highest US court will review Trump’s tariffs in November. Tariffs will remain in place until then, with Trump’s team already exploring different options if the judges rule that tariffs are illegal.

In the meantime, Trump continues to use tariffs as a pressure tool. He remains displeased with India and China over their close ties with Russia, and their extensive oil and gas purchases. Instead of increasing US tariffs on Indian and Chinese US imports, Trump is pressuring the EU to impose 100% tariffs on these countries. That could quickly backfire, as eurozone growth remains weak, with the latest political developments in France expected to cast a shadow over economic activity in the bloc’s second-largest economy.