Main Street optimism edged higher in August, as the rose to 100.8. That reading sits above the long-term average of 98 but missed the consensus estimate of 101. Stronger sales expectations led the improvement, with a net 12% of owners anticipating higher real sales volumes. This represents a six-point jump from July. The Uncertainty Index also declined by four points, showing less concern around financing and capital expenditures.

Business health improved as 68% of owners rated conditions “good” or “excellent.” Profit trends notched their best level since March 2023, while fewer firms raised prices, and financing costs eased. The average short-term loan rate fell to 8.1%, the lowest since May 2023, providing some relief for Main Street borrowers.

Still, Main Street challenges remain. Owners have consistently cited labor quality as the top issue, with 32% of Main Street reporting unfilled job openings. While this marks the lowest share since 2020, it still reflects persistent hiring difficulties, especially in construction and manufacturing.

The bottom line: For investors, the survey results are a welcome contrast to broader signs of economic cooling. Main Street is becoming more optimistic again, but the miss relative to expectations and ongoing labor shortages temper the headline.

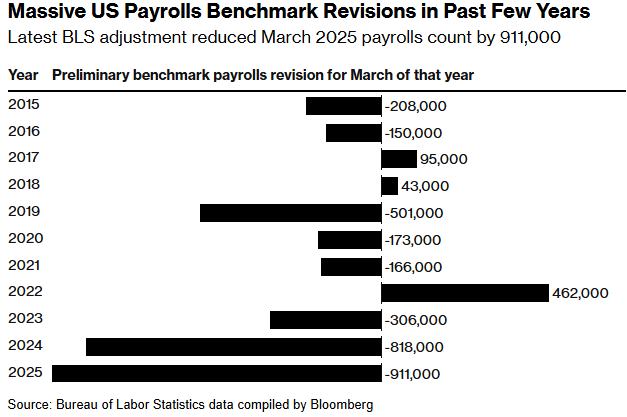

Preliminary Payrolls Revision Disappoints

The BLS released its preliminary estimate of the annual benchmark revision yesterday, showing job growth for the 12 months ending in March was overstated by 911,000. While the figure grabbed headlines, it’s important to remember this is a preliminary estimate. The BLS won’t publish the final revision, which will adjust monthly payroll data from April 2024 to March 2025, until February 2026. Most notably, in recent years, the final revision has come in smaller than the first estimate.

The process is routine. The BLS reconciles its monthly survey with more comprehensive state unemployment tax records each year, providing a “preview” in September and a final adjustment later. As shown in the chart from Bloomberg below, last year’s preliminary revision showed an 818,000 job overstatement. However, the final adjustment in February reduced the overstatement to 598,000.

The key question is whether today’s report changes the Fed’s calculus. The answer is no. Powell flagged at that such revisions were likely, noting that administrative data already pointed to a material downward revision. Moreover, the adjustment doesn’t alter unemployment rates, given that they are derived from another data set. Finally, the revision says nothing about job creation since March. As such, while the revision bolsters the odds of a this month, it’s unlikely to shift monetary policy outlook materially.

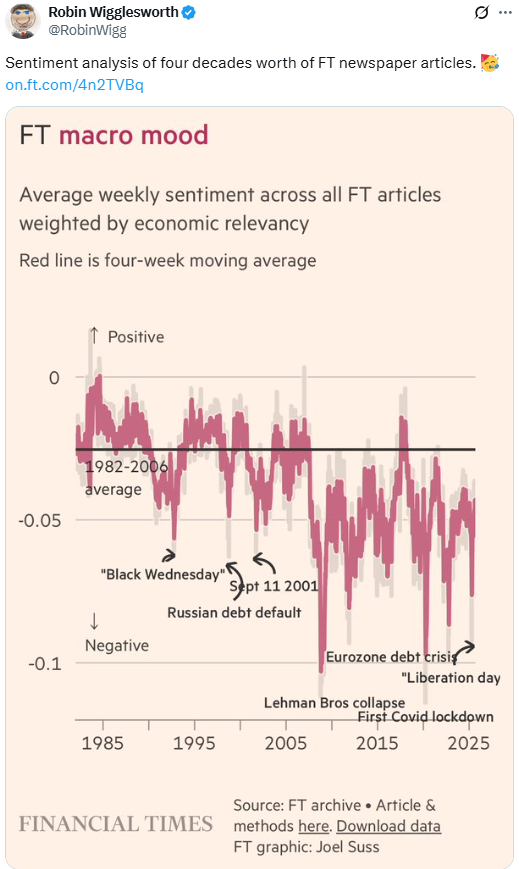

Tweet of the Day